Electronic

Delivery of Documents – Disclosure and Consent

CONSUMERS COOPERATIVE CREDIT UNION

847.623.3636 or 877.275.2228

This Electronic Delivery of

Documents Disclosure and Consent states

the conditions for the electronic receipt of documents including periodic

account statements, account disclosures and other notices.

These terms and conditions are in

addition to those terms and conditions outlined in agreements applying to any

account you have with us.

You are encouraged to print a copy of this document and keep

it for your records.

Electronic

Delivery of Documents

By consenting to the electronic delivery of documents, you agree

that Consumers Cooperative Credit Union (CCU) may, but is not obligated to,

send any and all of its account documents, disclosures or other notices to you

electronically (collectively referred to as “Electronic Documents”).

You can elect to withdraw your consent to Electronic Delivery of

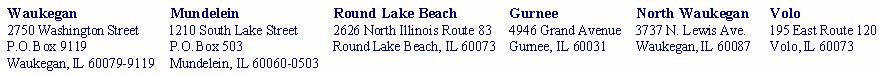

Documents at any time by calling us at 877-ASK-CCCU (877-275-2228), by visiting

any branch office listed below, or by standard mail at:

Consumers Credit Union

Waukegan, IL 60079-9119

The legal validity and enforceability of prior electronic

documents will not be affected if you withdraw your consent.

You also may receive a paper copy of your documents upon request,

by contacting the Credit Union using the same methods stated above. Fees may apply as disclosed in our current

Fee Schedule.

Types of Documents

Included and Method of Delivery

Your

Consent to Electronic Delivery of Documents applies to all documents that we

provide to you in connection with your account activity or services, or

requests for other products and services.

Electronic

documents may include any information, statements, or disclosures related to

any of CCU’s deposit and loan products, or other services associated with your

membership account, as well as periodic statements. Electronic documents may

also include important information such as, but not restricted to, share certificate renewal notices,

non-sufficient funds notices, overdraft protection notices, loan payment

notices, Loan Advance Vouchers and Subsequent Action notices, information used

for tax purposes, and any other account notifications and disclosures required

by the Truth In Savings Act, the Electronic Fund Transfers Regulation E, the

Truth In Lending Act, the Privacy Act, the Internal Revenue Service (IRS), or

other documents required by Federal or State Regulations.

If

you consent to Electronic Delivery of Documents, we will provide the documents

on our website or other secure internet delivery method. We will send you an e-mail or other online

notification when relevant information is available for access. Any documents we send to you will be deemed

to have been provided on the date we notify you of the availability.

You will gain access to your

statements, disclosures and notices through the use of your Internet-enabled

device, your Internet Service Provider, and your Consumers CU Online Banking

Account & Password, or other secure method.

Electronic

documents will be available for viewing & printing for at least 18 months.

Required Computer Specifications

To receive

electronic statements, notices, disclosures or other

electronic documents, your computer hardware, software and your Internet

service provider (.ISP.) must meet the following specifications:

ü Internet

Explorer 7 or Above

ü FireFox

3.6 or above

ü Google

Chrome

ü Adobe

Acrobat Reader or other Portable Document Format (PDF) reader must be installed

for online account opening services or personal document archiving

ü E-mail

Address

We will provide

you with notice that your electronic documents are available via e-mail to the

last known e-mail address provided by you. The notice will identify the account

involved and the location where the document is available. You agree to notify us promptly of any change

of your e-mail address.

Contact Information

You are responsible for ensuring

that we have your current e-mail address for purposes of receiving electronic

communications. If your e-mail address changes, you must contact us to provide

us with updated information. If you fail to notify us of any change in your

e-mail address, you agree that we may continue to provide communication to you

at the e-mail address maintained in our records.

If you

have a joint account as noted and

provided for in your CU Account Agreement, your email address may be changed by

any authorized party to your account.

Please visit any branch, or contact us

in writing at the address above, or by phone at 877-ASK-CCCU

(877-275-2228).

Identity verification may be requested for any changes to your account

information.

Fee Schedule

Consumers Credit Union

offers the benefits and convenience of this Service to you free of charge. We

reserve the right to update and/or change the fee schedule for this or other

services at any time. Members will be

provided at least thirty days notification of any changes for fees applicable

to this Service.